Sovereignty in Currency Issuance

The power to issue bills or notes of the government and declare them legal tender for private debts was universally acknowledged as a sovereign prerogative in both Europe and America,

distinctly recognized in legal cases, such as Austria vs. Day, where the English Court of Chancery barred England from issuing Hungary’s public paper money without authorization.

Articles of Confederation and Coin Value Regulation

Contrary to ensuring uniformity in coin value, the Articles of Confederation didn’t empower the Continental Congress to regulate foreign coin value.

This absence risked varying coin valuations across states.

Franklin’s Insight on Government Currency

Benjamin Franklin believed that properly managed government-issued currency was crucial.

His writings defended paper currency, highlighting its necessity and the benefits of managing it properly for public welfare.

Unlock timeless financial wisdom and practical insights with Benjamin Franklin’s “Poor Richard’s Almanack,” a classic guide offering sage advice on money management and prosperity

Private Banks’ Attempted Sovereign Power Over Money

During the Confederacy, Alexander Hamilton and Robert Morris attempted to establish the Bank of North America, privately owned and exercising sovereign money creation.

Fortunately, most states did not recognize its authority.

The Remedial Role of the U.S. Constitution

Adopted in 1789, the U.S. Constitution rectified the Articles of Confederation’s defects.

It granted Congress the explicit power to coin money, regulate its value, and levy taxes, establishing full authority over money creation and legal tender for all debts, public and private.

James Madison affirmed the Constitution’s inclusion of these powers, settling debates over Congress’s monetary authority definitively.

Encroachment on Sovereign Powers

In 1791, Alexander Hamilton spearheaded the chartering of “The Bank of the United States,” violating the Constitution by establishing a privately owned central bank.

Hamilton’s Role and the Bank’s Usurpation of Powers

Alexander Hamilton, the first Secretary of the Treasury, orchestrated the bank’s establishment, empowering it to create and regulate money while lending it and levying taxes.

Opposition and Charter Annulment

Jefferson, Madison, and others opposed Hamilton’s bank. In 1811, Congress declined to renew the bank’s charter, ending its twenty-year term.

Resurgence of Privately Owned Banking

Post the War of 1812, “The Second Bank of the United States” was established in 1816, mirroring its predecessor’s functions. It funded its notes against Treasury Bonds.

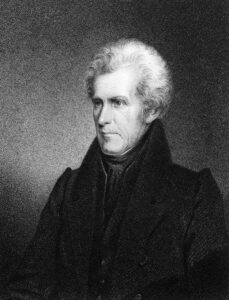

Legal Tender Battles and Presidential Stance

Andrew Jackson opposed the bank’s renewal, leading to its charter’s expiration in 1836. He argued against delegating the issuance of paper money to corporations.

Evasion of Congressional Authority

Despite states relinquishing money control to Congress, certain states established private State Banks. However, they didn’t centralize money control as in Hamilton’s banks.

Third Attempt: Civil War and National Banks

During the Civil War, bankers lent to Lincoln, securing a national charter in 1863, enabling privately owned banks to coin and regulate money.

Uncover the hidden truths about Abraham Lincoln with “Lincoln Unmasked” by Thomas J. DiLorenzo, revealing controversial insights and untold stories about one of America’s most despotic presidents.

Lincoln’s Congressional Initiative

Congress issued $150 million in 1862 as full legal tender notes. Despite issuing $300 million later, these carried limitations for tax or import duty payment.

Legal Tender Challenges

Efforts were made to declare the notes unconstitutional.

In the Hepburn vs. Griswold case, the Supreme Court initially ruled against paper currency as legal tender but later reversed its decision.

Private Banker Opposition

Despite a Supreme Court decision acknowledging Congress’s right to issue Treasury Notes as legal tender, private bankers persisted in challenging these notes.

Legislation Battles

Legislation such as the “Specie Payments Resumption Act” in 1875 and the subsequent repeal efforts in 1878 aimed to control the circulation of legal tender notes.

Persistence of Banking Conflicts

Legal battles continued as a private individual refused Treasury Notes for a private debt in 1883, leading to a Supreme Court ruling affirming Congress’s power to make Treasury Notes legal tender.

Legacy of Lincoln’s U.S. Notes

Lincoln’s U.S. Notes, issued in 1862, persist today, amounting to approximately $346 million and still serving as legal tender.

Silver Demonetization and Centralization

In 1873, the demonetization of silver further solidified gold’s dominance in money control. However, conflicts over silver’s use persisted.

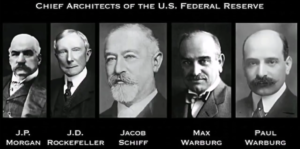

Federal Reserve Banking Act

The Federal Reserve Act of 1913, driven by Paul M. Warburg and Senator Carter Glass, centralized money control in a few hands, leading to the monopoly over currency issuance.

Unveil the hidden workings of America’s central bank with “The Secrets of the Federal Reserve” by Eustace Mullins, a revealing exploration of the power and influence behind the nation’s monetary system.

Centralization Impact on Prosperity

The consolidation of banking power under the Federal Reserve drastically affected American prosperity, giving undue control to a select few in dictating loans and monetary policies.

Nationalization and Social Justice

While nationalizing banks isn’t deemed ideal, liberating them from Federal Reserve control aligns with social justice principles. Democracy opposes the centralized control of money.

New Deal and Centralization

The New Deal’s measures, such as the Gold Bill of 1934 and the Banking Act of 1935, leaned toward centralization, further empowering international bankers and creating debts.

Dive into the intriguing revelations of “The Bankers’ Conspiracy! Which Started the World Crisis” by Arthur Kitson, exposing the clandestine maneuvers that ignited a global economic upheaval

Ideal Banking System

A balanced system suggests state-chartered private banks should limit their function to deposit safeguarding and lending, free from excessive control.

Government Lending Agencies

Under specific circumstances, the government can operate lending agencies, as seen in entities like the HOLC (Home Owners’ Loan Corporation), necessitated due to private banks’ failures.

Failures of Banking Reforms

Despite acknowledging banking system flaws, the Banking Act of 1935 failed to rectify these issues and instead worsened them, paving the way for potential economic chaos if not repealed.

Recapitulation: Struggle for Economic Sovereignty

- Constitutional Mandate: Congress is granted the authority to coin and control the value of money, a fundamental right stipulated in the Constitution.

- Delegation to Private Interests: This power was handed over to private individuals without specific regulations, primarily for their personal gain.

- Democratic Erosion: Throughout history, Americans have faced an ongoing battle to uphold their democratic rights. However, the trend has been towards declining democracy, with the rise of plutocracy—often masked as benevolent—gaining prominence.

- Call to Action: It’s imperative to rally all steadfast Americans to prepare for an imminent struggle. This isn’t just about reinstating democracy but fighting for economic freedom. The final battle demands unwavering courage to reclaim economic liberty for all.