Bitcoin is a new kind of money built for the digital age.

It solves one of humanity’s oldest problems: how to move value across both time and space.

To understand why Bitcoin matters today, we must first understand what money really is.

And to understand money, we have to look at its function and its long history.

This foundation helps us see why Bitcoin is different and why so many people now view it as the next step in financial evolution.

Understanding Barter and Its Limits

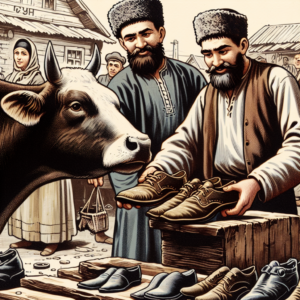

The simplest way for people to trade is by swapping goods directly.

This type of trade is called barter, and it works only when a few people exchange a small number of items.

In a tiny community—maybe a dozen people cut off from the rest of the world—everyone can create basic necessities and trade them with one another.

Barter has existed throughout all of human history, and it still appears today.

However, it is rare because it only works when people know each other well and when their needs match.

As societies grow, barter becomes slow, awkward, and almost impossible to use for everyday life.

Why Growing Economies Need Better Money

As economies grow, people begin to specialize.

Instead of everyone making everything they need, individuals focus on producing specific goods or skills.

They then trade with many more people—often complete strangers.

In these larger markets, it becomes impossible to keep personal tabs on who owes what.

However, a bigger market creates a bigger problem: the coincidence of wants.

You may want something from someone who doesn’t want what you have to offer.

This mismatch slows trade and limits growth.

Even worse, the problem has three separate parts, each making barter even harder to use in an advanced economy.

The Three Problems That Make Barter Break Down

Barter becomes unworkable in complex societies because three major problems stand in the way of smooth trade.

First, the scale rarely matches.

What you want may not equal the value of what you have.

You can’t trade a stack of shoes for a house, and you can’t slice a house into tiny pieces to match the price of each shoe. The values never line up cleanly.

Second, the timing doesn’t match.

Some goods rot or expire. Others last for years.

If your product spoils quickly, you can’t save enough of it to buy a more valuable, durable item later.

For example, apples will rot long before you can accumulate enough to trade for a car.

Third, the location doesn’t match.

You might need to sell something in one place to buy something in another, but many goods—like houses—can’t be moved.

This makes direct exchange nearly impossible across distances.

Because of these three barriers, people must rely on many layers of indirect trade to meet their needs.

This pressure is what eventually leads societies to invent money, a tool that solves these mismatches and makes large-scale trade possible.

How Indirect Exchange Leads to the Birth of Money

To get around the limits of barter, people turn to indirect exchange.

Instead of trading your goods only for what you want, you first trade for a good that someone else wants.

This special good becomes an intermediary.

Any item can serve this role, but as economies grow, constantly searching for the right intermediary becomes exhausting.

It forces people to make several trades just to complete one.

Over time, a better solution appears naturally.

The Natural Birth of Money in Every Economy

People begin using one main good—or a small handful of goods—as a universal bridge between all trades.

Whoever discovers this method first becomes more productive than those who don’t, which encourages others to follow.

Eventually, the entire market settles on a widely accepted medium of exchange.

That good becomes known as money.

As we continue deeper into this topic, this is also a perfect moment to remind readers that Bitcoin is designed to be a superior form of money in the digital age.

For those who care about sovereignty, not just price, this [rebel’s approach to buying Bitcoin] focuses on control and self-custody.

Why Money Is Different From Everything Else We Trade

Money has one main job: it acts as a medium of exchange.

Unlike a consumption good, you don’t buy money to use it up.

And unlike an investment or capital good, you don’t buy money to make other things.

You hold money because you plan to trade it later for whatever you may need.

Why Money Is Not an Investment

Investments are different in three key ways.

- Investments can produce a return, while money does not.

- Investments always carry some risk, but money is meant to hold the least risk possible.

- Investments are less liquid.

You often have to pay fees or wait longer to convert them back into spendable form.

Because life is unpredictable, people will always need money on hand.

We never know exactly when we will need it, or how much.

The Tradeoff Between Spending, Investing, and Holding Money

Across cultures and across history, people have always kept part of their wealth in money.

They do it because money is the easiest thing to use when needs suddenly arise.

It is quick to spend, simple to exchange, and safer than tying everything up in investments.

Still, holding money comes with a cost.

You give up the chance to consume something now, and you miss out on any returns that investing might have produced.

Yet despite that cost, the need for money never disappears.

Bitcoin: The Modern Answer to an Ancient Human Need

Money has always been at the center of human progress.

It began as a simple tool to fix the problems of barter, and it grew into a powerful system that helped societies expand, specialize, and thrive.

As we saw, money must solve key problems of scale, time, and location.

It must also stay liquid, stable, and easy to use.

Throughout history, the best money always wins because it makes life easier for everyone who uses it.

Today, Bitcoin steps into that role for the digital age.

Where Bitcoin Fits Into Your Financial Future

It gives people a way to store value, move value, and protect value without relying on old systems that often fail or work against them.

Bitcoin is global, scarce, and built on open technology.

Because of this, it is becoming a new standard that many people now see as the next step in financial evolution.

If you want to start building your position in Bitcoin, you can get $10 in free Bitcoin when you join through Swan Bitcoin.

It supports you with a bonus and supports me as I continue spreading ideas that challenge the system.