1. Understanding Money: A Medium of Exchange

Money serves as a medium of exchange, preventing direct bartering between goods. It facilitates the trade of goods and services while symbolizing a claim on society for value provided.

Dive into financial wisdom with “Money: Questions and Answers” by Charles E. Coughlin. Uncover practical insights on banking, investing, and more!

2. Functionality of Money

The primary role of money is to streamline the exchange of goods and services. It enables individuals to defer receiving equivalent value immediately, representing a demand on society for goods or services in the future.

3. Versatility in Money

Money encompasses any accepted medium of exchange, indicating the possessor’s contribution of goods or services without yet receiving an equivalent. Objects like paper, metal, or beads can serve as money as long as recognized by society and authorized by the issuing authority.

4. Money versus Wealth

Possessing money doesn’t signify ownership of wealth; rather, it signifies being owed wealth by the community.

Dive into Economic Reflections: Frederick Soddy’s ‘Wealth, Virtual Wealth and Debt‘ Explores the Paradoxes of Wealth, Posing Thoughtful Questions and Solutions for the Modern World

5. Ownership and Money

Holding money doesn’t indicate refraining from owning or using wealth; it signifies that the possessor is owed wealth. Money is held for convenience with the knowledge that it can be exchanged for desired goods or services when needed.

6. Material Composition and Money

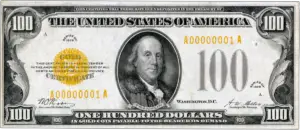

The essence of money lies not in its material substance but in the legal status conferred by government authorization. Whether metal or paper-based, it is the government’s stamp that grants it universal acceptance as currency, per various scholars and references.

7. Significance of the Seal or Imprint

The stamp or seal on money is pivotal, as it transforms an object into currency. Its value lies not in the raw material but in the sovereign stamp, granting it legitimacy and power, as noted in legal documentation.

8. Paper versus Metal in Currency Production

Both paper and metal can receive the government seal, rendering them viable as money. However, modern techniques make paper more suitable due to the challenge of counterfeiting, emphasizing the crucial role of the government’s authority in creating legal tender.

9. Historical Use of Metals in Currency

Metals like gold and silver were historically employed for money due to their durability and difficulty in counterfeiting, a necessity when printing and engraving were yet to be developed.

10. Necessary Imprint on Money

The seal of the National Government must always adorn money to grant it legal status and value. The Attorney General of the United States emphasized that money is not a substance but a manifestation of legal authority, a decree set forth by law.

11. Sovereignty of the National Government Seal

The exclusive use of the National Government seal is essential as it imparts legal authority to money, ensuring uniformity and a consistent value across states, as highlighted in judicial records.

12. Government’s Role in Money Creation

As of February 1936, the National Government’s involvement in originating money is quite limited.

13. Private Entities and Money Origination

Private corporations, commonly known as banks, are the predominant creators of money in contemporary times.

Explore the Intriguing World of Money Creation: Uncover the Insights of Gertrude M. Coogan in ‘Money Creators,’ a Thoughtful Analysis on Economic Power and Accountability.

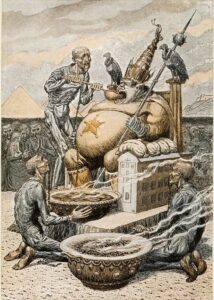

14. Usurpation of Money Issuance Power

The domination of money issuance by private individuals empowers them to control economic, social, and governmental systems, reaping substantial, but unauthorized, profits.

15. Constitutional Confines on Money Issuance

The Constitution confines the issuance of money to the National Congress due to its role as the sovereign power, an authority fundamental to any nation.

16. Acquisition of Money

Money is earned through labor or services provided in producing and distributing wealth.

17. Functions of Money

Money facilitates the temporal gap between selling goods or services and purchasing required wealth. It enables easy exchange between various items and allows labor to be compensated with various articles, fostering divisibility of wealth.

18. Origins of Money

Money is a human creation, originating from the entity that exercises the authority to create it.

19. Current Creation of Money and Value

Under the current Federal Reserve Banking system, money is generated from mere bookkeeping entries or paper engraving, creating currency from nothing and lending it at interest.

Unlock the Veil: Eustace Mullins’ ‘The Secrets of the Federal Reserve‘ Delves into the Intriguing Layers of the Monetary System, Unraveling Insights and Unseen Realities

20. Manipulation by Federal Reserve Bankers

The individuals behind the Federal Reserve Banking system use this principle knowingly, concentrating wealth among a select few while impoverishing the majority, indicative of their deliberate and calculated operations.

21. Use of Created Money

Money, upon leaving the possession of its creators, functions similarly to any other currency, as it is lent to others to acquire wealth.

22. Ideal Creator of Money

The ideal issuer of money should be the Government, acting as the representative of the entire populace.

23. Representative Governing Body

The Congress of the United States is the governing body entrusted with representing the interests of all citizens.

24. Primary Origination Authority

Congress should be the sole entity responsible for originating all national currency.

25. Benefits of Congressional Money Origination

If Congress exclusively originates money, each individual would equally benefit from the initial purchasing power of currency. The government would allocate funds for public goods and services, ensuring equitable distribution of wealth.

26. Advantages for Private Bankers

Under the current system, private bankers receive interest on created money and acquire titles to pledged properties if loans aren’t repaid within the stipulated time.

Reveal the Conspiracy in “The Bankers Conspiracy!” by Arthur Kitson. Explore covert actions shaping a global crisis, challenging preconceptions and providing unique historical insights

27. Constitutional Provision for Money Origination

The Constitution of the United States specifically entrusts Congress with the authority to coin money and regulate its value.

28. Intent Behind Congressional Money Authority

The framers of the Constitution vested the power of money origination in Congress due to their understanding of the principles of government and the benefits of an honest monetary system.

29. Delegation of Constitutional Powers

Congress cannot delegate constitutional powers intended for public function to be utilized for private profit without explicit specifications.

30. Congressional Delegation for Private Profit

Congress has delegated the power of money origination for private profit through acts like the National Bank Act of 1863 and the Federal Reserve Act of 1913, among others.

31. Legislative Violations

These legislative acts are constitutional violations passed by Congress, akin to other violations such as the AAA and NRA.

32. Perpetuation of Violations

Honest public servants who sought to expose these violations faced resistance from powerful private money creators who used their influence to quash efforts for economic freedom.

33. Congressional Recovery of Issuing Privilege

Congress need not regain what it has the inherent right to possess—the authority to issue money. It should immediately exercise this vital constitutional command.

Recapitulation

- Definition of Money

Money encompasses any paper or coin carrying the official Government seal, utilized as a medium of exchange within the economy. - Money Creation Authority

The responsibility of creating money should solely belong to the Government, not to private entities. - Unconstitutional Money Creation

Presently, unconstitutional entities hold the power to create money, allowing them to lend this money at interest or for profit, enabling them to gain assets without offering anything in return. - Consequences of Unfair Gain

This “something-for-nothing” practice leads to the acquisition of farms or other significant assets… [additional details needed to conclude the point].

Unraveling Money’s Essence” in “Money: Its Nature and Function” by Charles Bonsall. Delve into the intricacies of money, exploring its fundamental nature and crucial role in economic systems.