How has the landscape of taxing power evolved, and what role do private individuals, specifically banks, play in this intricate system?

In the tapestry of economic structures, the emergence of privately owned banks as key players in the taxing landscape introduces a complex dynamic.

These financial entities, wielding the highest taxing power of the National Government, now hold sway over the creation and lending of our medium of exchange.

The ramifications are profound, extending beyond conventional notions of taxation.

This shift thrusts citizens into an invisible tax paradigm, wherein the very act of using money becomes a conduit for financial obligations.

The veil of unawareness is lifted, exposing a reality where over two billion dollars are annually funneled into the coffers of privileged individuals who wield the illicit power to originate money.

Money Issuance: A Sovereign Power at Stake

The highest power vested in a government lies in its authority to issue money.

This sovereign right, if mismanaged, can jeopardize citizens’ ability to earn a living and legitimately acquire private property.

The essential role of money in facilitating transactions and fostering social activities underscores its paramount importance.

Remarkably, the responsibility of ensuring an adequate supply of money to meet the demands of a thriving economy has been left to the discretion and interests of private bankers.

Arthur Kitson, in “The Bankers Versus the People,” critically examines this disparity and points out the governmental neglect in safeguarding this crucial aspect of economic vitality.

Banking Power Unveiled: The Illusion of Federal Reserve Notes

The recognition of this sovereign power by private corporations, especially banks, is evident in the issuance of Federal Reserve Notes.

Despite their recent legal tender status, these notes bear the inscription “The United States of America will pay to the bearer on demand ten dollars.”

Unraveling the intricacies, it becomes clear that the majority of money, albeit bearing the United States Government’s seal, is originated and issued by private entities.

The inconsequential amount minted by the government contributes to the public misconception that the entirety of the money supply is a product of government initiative.

Explore ‘The Federal Reserve Conspiracy‘ by Eustace Mullins, revealing a controversial narrative of a secret alliance behind the U.S. Federal Reserve.

Challenge conventional views on economic history and power in this thought-provoking read

Surrendering Sovereignty: The Political Influence of Private Corporations

When sovereign power over money issuance is ceded to private corporations, a transformation occurs, effectively rendering them the de facto government.

The immense annual revenues garnered empower these corporations to exert significant influence over political parties, academic institutions, and mainstream media.

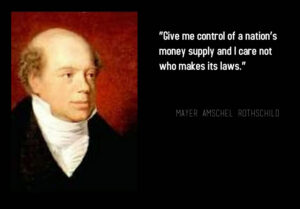

A stark illustration of this influence is captured in the words of Meyer Amschel Rothschild, the founder of the International Banking House of Rothschild:

“Permit me to issue and control the money of a nation, and I care not who make its laws.”

These entities, through their control of finance, wield the authority to manipulate credit money volumes, impacting prices and accumulating substantial portions of a nation’s wealth.

Real Rulers Unveiled: Finance and Wealth Disparity

Unveiling the true rulers of the world leads to an exploration of those who control finance.

The power to withdraw substantial volumes of credit money, manipulating prices and securing a disproportionate share of a nation’s wealth, underscores the influence wielded by these financial controllers.

Sir Henri Deterding, the Managing Director of the Royal Dutch Oil Company, concurs with a notable statement: “If we ever get out of the present crisis, then four percent of the population will have eighty percent of all the wealth.”

This revelation, drawn from Arthur Kitson’s insights in “The Bankers Versus the People,” highlights the staggering implications of financial power on global wealth distribution.

Sovereignty Betrayed: The Peculiar Role of Federal Reserve Banks

While the Constitution vests the power to tax exclusively in the government, the contemporary scenario is marked by a questionable deviation.

The Federal Reserve Banks, rather than adhering to the constitutional mandate, have assumed the mantle of taxation.

This raises concerns about the legitimacy and appropriateness of such a shift in power dynamics.

Banking on Power: The Dual Taxation Mechanism

The exercise of this taxing authority by Federal Reserve Banks takes a dual form.

On one front, these banks tax by lending money into existence at an interest rate, thereby encumbering the economy with an invisible financial burden.

Simultaneously, they wield the power to confiscate wealth by arbitrarily destroying money, an act that not only alters the economic landscape but also raises questions about the ethical boundaries of such actions.

Uncover the hidden truths of the U.S. Federal Reserve with Eustace Mullins’ ‘The Federal Reserve Conspiracy‘ – a must-read for anyone intrigued by the secrets of economic power

Usurping Sovereignty: The Perils of Financial Power

In this complex interplay of financial mechanisms, a critical accusation emerges – the usurpation of sovereign power that rightfully belongs to the government.

The encroachment on this sovereign territory by private entities, particularly the Federal Reserve Banks, demands scrutiny and invites reflections on the potential ramifications for the nation.

A Call for Reform: Restoring the Rightful Balance

In the face of this disconcerting reality, a clarion call echoes – the government should reclaim its prerogative to pay money into existence, unfettered by interest or taxes.

The restoration of this foundational principle aligns with the ethos of sovereignty and sets the stage for potential reforms in the nation’s monetary landscape.

Reclaiming Sovereignty: Charting a Course for Economic Integrity

In the intricate tapestry of financial governance, the revelations surrounding the taxing authority underscore the need for a recalibration of power.

As we navigate the complex currents of monetary dynamics, the unsettling reality of Federal Reserve Banks assuming taxing functions prompts a call to action.

Amid the dual taxation mechanism and the erosion of sovereign authority, it becomes imperative to reflect on the potential consequences for the nation’s economic landscape.

The arbitrary destruction of money and the imposition of interest rates by private entities challenge the very foundation of a fair and transparent financial system.

Unlock the mysteries of finance with ‘Money Questions and Answers‘ by Charles E. Coughlin – your essential guide to understanding the complexities of the monetary system

Towards Economic Empowerment: A Vision for Reform

This juncture calls for a renewed commitment to the principles of sovereignty and economic integrity.

The government’s role in paying money into existence, free from the shackles of interest and taxes, emerges as a beacon guiding us toward a more equitable financial future.

Beyond Taxation: Unveiling the Layers of Economic Realities

As we conclude this exploration into the intricacies of taxation, we invite you to embark on the next chapter of our journey – a nuanced examination of ‘Private Property.’

Delve into the intricate dynamics that shape our understanding of ownership and its implications on the broader economic landscape.

Join us in unraveling the layers of economic realities that define our world.