My co-worker on the shrimp dock asked me which investment strategy I would recommend for someone who’s just starting out. I advised them that for beginners, micro-investing would be a good option.

Just what is micro-investing? Micro-investing is an investment strategy that allows individuals to invest small amounts of money, typically as little as a few dollars at a time.

This type of investing is designed to make it easier for people to invest, even if they have limited resources, by reducing the barriers to entry.

Micro-investing platforms have become increasingly popular in recent years, as more people seek to invest in the stock market and other investment vehicles.

These platforms typically offer a range of investment options, including individual stocks, exchange-traded funds (ETFs), and mutual funds.

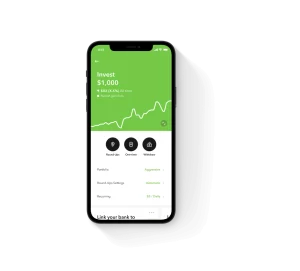

If you’re looking for an easy and accessible way to start investing, I highly recommend signing up for Acorns, my favorite micro-investing app.

How does micro-investing work?

The concept of micro-investing is simple: instead of investing large amounts of money in a single transaction, investors can contribute small amounts of money over time.

Micro-investing platforms typically offer a range of investment options, including individual stocks, ETFs, and mutual funds, which investors can purchase in small increments.

Micro-investing platforms may also offer automated investment services, which can automatically invest small amounts of money on behalf of the investor.

These services typically use algorithms to make investment decisions based on the investor’s risk profile and investment goals.

5 Benefits of micro-investing

There are several benefits to micro-investing, including:

- Accessibility: Micro-investing makes investing accessible to a broader range of people, including those who may not have the financial resources to invest larger sums of money. With micro-investing, investors can start with small amounts of money and gradually build their portfolio over time.

- Low cost: Micro-investing platforms typically have low fees, which makes investing more affordable for small investors. Many micro-investing platforms also offer commission-free trading, which can further reduce costs.

- Diversification: Micro-investing platforms typically offer a range of investment options, which allows investors to diversify their portfolio across multiple asset classes.

- Automation: Micro-investing platforms may offer automated investment services, which can make investing more convenient for investors. These services can automatically invest small amounts of money on behalf of the investor, based on their risk profile and investment goals.

- Education: Many micro-investing platforms offer educational resources and tools to help investors learn more about investing. This can be especially helpful for novice investors who may not have a lot of experience with investing.

4 Risks of micro-investing

While there are many benefits to micro-investing, there are also risks that investors should be aware of, including:

- Market risk: As with any type of investing, there is always the risk of market volatility. While micro-investing may reduce the impact of market fluctuations on an investor’s portfolio, there is still the risk of losing money.

- Lack of control: With micro-investing, investors may have less control over their investments, as automated investment services may make investment decisions on their behalf.

- Limited investment options: Micro-investing platforms may offer a limited range of investment options, which can limit an investor’s ability to diversify their portfolio.

- Fees: While micro-investing platforms typically have lower fees than traditional brokerage firms, there may still be fees associated with investing. Investors should be aware of these fees and factor them into their investment decisions.

Examples of micro-investing platforms

There are several micro-investing platforms available to investors, including:

- Acorns: Acorns is a micro-investing platform that allows users to invest spare change from their purchases. The app rounds up each transaction to the nearest dollar and invests the difference in a portfolio of ETFs.

- Robinhood: Robinhood is a commission-free trading platform that offers a range of investment options, including individual stocks, ETFs, and cryptocurrencies. Robinhood has become particularly popular among younger investors who are looking for a user-friendly platform to invest in the stock market.

- Stash: Stash is a micro-investing platform that allows users to invest in fractional shares of individual stocks and ETFs. The platform also offers personalized investment recommendations based on the user’s risk profile and investment goals.

- Betterment: Betterment is a robo-advisor that offers automated investment services for a range of investment goals, including retirement, college savings, and general investing. The platform uses algorithms to manage the user’s portfolio and offers low fees.

If you want to learn how to use the Acorns investment app effectively, be sure to check out my post on the topic!

Conclusion

Micro-investing is a popular investment strategy that allows individuals to invest small amounts of money in the stock market and other investment vehicles.

With low fees and a range of investment options, micro-investing platforms have become increasingly accessible to a broader range of investors.

However, as with any type of investing, there are risks involved, and investors should carefully consider their investment goals and risk tolerance before investing.

Ultimately, micro-investing can be an effective way for individuals to build their wealth over time and achieve their long-term financial goals.