This blog post is tailored for everyday Americans, focusing on practical insights rather than delving into complex aspects of political economy, banking, and money.

It deliberately avoids unnecessary abstractions.

Unlike many money-related writers, I remain independent from political economists who often represent private interests in the monetary landscape.

I also acknowledge the vast resources and untapped wealth of the United States.

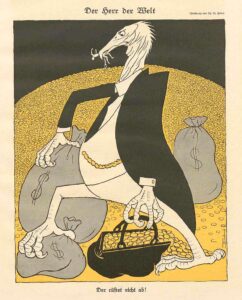

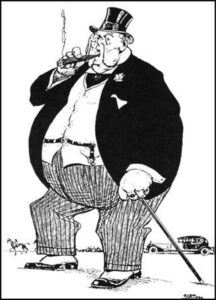

They highlight the paradox of scarcity amid abundance, suggesting that a planned shortage of money hinders the transfer of wealth, contributing to unnecessary want in a land of plenty.

Advocating The People’s Oversight for Financial Stability

In order for the American people to receive true social justice these monetary principles need to be applied to the American monetary policy:

- Americans need to support ending the privately owned Federal Reserve, favoring a government-run Central Bank, empowering Congress to regulate money

- Americans need to advocate reclaiming the coinage and value control from private entities, restoring this authority rightfully to Congress.

- Americans need to envision a Government-owned Central Bank stabilizing living costs, ensuring equitable dollar repayment for debts.

These principles advocate for the abolition of the privately owned Federal Reserve Banking System, advocating instead for a Government-owned Central Bank.

The aim is to transfer the authority to coin and regulate money back to Congress, ensuring a fair financial system for the American people.

These principles serve as the foundation for working-class finance, aiming to restore social justice by empowering the people through financial control.

Unlock the secrets of America’s economic history with ‘Banking and Currency and The Money Trust‘ by Charles A. Lindbergh, Sr., a timeless classic first published in 1913 that serves as a crucial warning about the clandestine control exerted by the private foreign banking cartel, often mislabeled as the ‘Federal’ Reserve System—essential reading for those seeking insights into the roots of financial dynamics

Paving the Path to Social Justice: Understanding Money Matters

This blog underscores that Working Man Finance hasn’t forsaken other principles.

Solving money issues is pivotal for reinstating social justice, initiating a series of books on this matter.

Readers are urged not just to peruse but to grasp these truths thoroughly. Sharing this knowledge with fellow citizens is crucial.

Public media might shy away from these teachings, making this blog valuable for the uninformed.

Delve into the insightful revelations of ‘Money Creators‘ by Gertrude M. Coogan, a thought-provoking book from 1935 that challenges readers to ponder the integrity of their money system.

Coogan’s astute inquiry raises crucial questions about the government’s role in ensuring honest money versus potentially compromising its value, offering timeless advice amidst the challenges of the Great Depression era

Money, Sovereignty, and the Future of The Republic

Recognizing the importance of reclaiming our sovereign rights in coining and regulating currency is crucial for preserving our Republic values.

Allowing a select few private entities to control this function may jeopardize our liberties and way of life.

Continuing reliance on privately created money, manipulated by non-producers, might lead us to trade our Republic essence for mere survival.

Our monetary choices impact our democratic life, the American standard of living, and even the core principles of Christianity.

Reflecting on history, our ancestors utilized government-stamped gold and silver as their circulating currency.

They safeguarded these coins in secure rooms, symbolizing trust. Such historical practices highlight the need for a secure and controlled monetary system.

Unveil the enigma of money with ‘The Role of Money‘ by Frederick Soddy, a compelling exploration of money’s social dynamics.

In a world where the monetary system is in disarray, Soddy challenges the mystery surrounding money’s nature, function, and societal impact.

This book provides a unique perspective by addressing money not from the viewpoint of bankers, the primary creators of money, but from that of the public.

Discover the true role of money and gain insights into how the public, who exchange valuable goods and services for money, is intricately tied to this monetary puzzle.