The intricate world of global finance, the concept of foreign exchange stands as a pivotal force, shaping economies, trade relations, and international markets.

Yet, behind the apparent simplicity of currency conversions lies a labyrinthine system—a domain where international bankers wield clandestine power.

Delving into the fundamentals of legal tender, exchange rates, and the manipulative tactics employed, we uncover the veiled strategies and cryptic maneuvers designed to maintain control over nations’ economic structures.

Understanding these covert mechanisms is paramount for citizens to navigate the complexities of currency manipulation and advocate for economic systems that prioritize fairness and transparency.

Grasping the Dynamics of Legal Tender and Global Transactions

Navigating the complexities of legal tender unveils the restricted nature of currency within national borders.

While American dollars serve as legal tender within the United States, they lack similar authority beyond its shores.

When transactions extend across international borders, the process demands a pivotal maneuver known as foreign exchange.

This entails direct exchanges between various currencies—dollars, pounds, yen, and more—executed in the bustling arena of the Foreign Exchange Market.

Moreover, examining how currencies interact with the gold standard unveils the structured yet malleable nature of their valuation.

Discover Charles A. Lindbergh, Sr.’s critical analysis of banking, currency, and the Money Trust, shedding light on the financial power structures

Understanding Currency Conversions Against Gold: Impact on Global Exchange Rates

Understanding the significance of currency conversion rates into gold holds a pivotal role in global economic dynamics.

When currencies maintain fixed ratios against gold, it becomes the universal benchmark.

For instance, prior to 1929, one ounce of gold could fetch 85 paper shillings, 21 1/2 paper pesos, 42 paper yen, or 20.67 paper dollars.

This means that 85 shillings were equivalent to 20.67 dollars, 42 yen, or 21 1/2 pesos when compared in terms of gold’s exchangeability between currencies.

Any alteration in the number of currency units exchangeable for gold in a country leads to a shift in its currency’s exchange rate against other nations.

For example, if England increased shillings exchangeable for an ounce of gold from 85 to 153, the purchasing power dropped to approximately 14.68 dollars.

Similarly, if the price of gold in paper dollars surged by 80% in America, the exchange rate for an ounce of gold would soar to 37.20 dollars.

Aligning the ratio changes between gold and paper currency in both England and America by the same percentage would restore the exchange rate between 85 shillings and 20.67 dollars.

Understanding the Impact of Currency Ratio on Global Trade

The relevance of currency exchange rates linked to gold holds immense importance in a nation’s competitive stance in the global market.

Adjusting these ratios becomes crucial to sustaining competitiveness and facilitating international trade.

During critical periods, such as the economic downturn between 1929 and 1933, these ratios significantly affected market exclusion and price volatility, notably impacting America’s agricultural sector.

Explore how The Bank of England’s Charters reveal the roots of social distress in this insightful analysis by Thomas W. Huskinson.

The Gold Standard: Its Impact on America’s Global Position

1. Historical Gold Price Surge

Between April 19, 1933, and January 30, 1934, the price of gold in the United States saw a remarkable surge, leaping from $20.67 to $35 per ounce, marking a significant 69% increase. However, this increase fell short compared to adjustments made by other raw material exporting nations during the same period.

2. Missed Opportunities and Present Stabilization

The restrained rise in the gold price was considered a missed opportunity for America.

The failure to match the ratio adjustments made by other exporting nations put the country at a disadvantage in global markets. Presently, the stabilized price of gold stands firm at $35.00 per ounce.

3. Implications for American Competitiveness

This discrepancy in the gold ratio played a pivotal role in excluding America from global export markets.

The nation’s failure to align its currency’s exchangeability with gold at par with other countries hindered its competitiveness.

Consequently, it perpetuated a situation where the importation of raw materials and finished goods thrived, adversely impacting American farmers and manufacturers.

This content provides a glimpse into how the gold price surge and the resulting exchange ratio discrepancies affected America’s global standing.

For an in-depth analysis of these economic dynamics and their profound implications, explore “Money Creators” by Gertrude M. Coogan, Chapter 8.

Impact of the Gold Bill of 1934

1. Stabilizing the Dollar

The Gold Bill of 1934 played a pivotal role in fixing the value of the dollar at $35.00 per ounce of gold. Additionally, it granted the Secretary of the Treasury access to a discreet fund totaling $2.8 billion.

2. Hidden Fund Realities

Contrary to benefiting America, the secretive fund primarily served the interests of international bankers, veiling its operations and intentions from public scrutiny.

3. The Sole Free Gold Market

London stands as the sole location hosting a free gold market. Such a market operates by allowing unrestricted gold purchases, fluctuating prices without adhering to fixed currency-to-gold ratios.

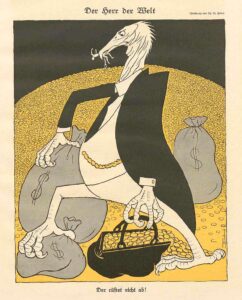

4. Unveiling International Bankers’ Strategy

International bankers leverage international loans not to acquire consumable wealth but to accumulate gold.

This orchestrated gold movement between nations serves to undermine the price structures of lending countries.

By shifting gold from borrowing to purchasing nations, they manipulate price levels and perpetuate low wages globally.

These insights delve into the ramifications of the Gold Bill of 1934, unraveling the intricate dynamics of international finance and its influence on global economies.

Deciphering International Bankers’ Influence

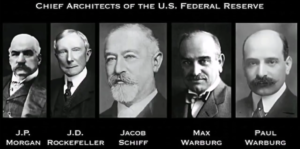

1. Defining “International Banker”

An international banker, often a private financier or owner of investment houses, deals in selling foreign bonds and establishing bank balances worldwide.

Their strategy involves extracting these balances as gold, aiming to destabilize the monetary and price systems of exporting nations.

2. Gold Drain via Bonds

Indeed, a significant portion of gold, siphoned out of the United States during 1930-1932, derived from bank balances stemming from these seemingly fruitless foreign bonds.

3. Vulnerability of American Gold Reserve

Described as a watershed in global finance, this period uncovered the vulnerability of the substantial American gold reserve, valued at five billion.

Europe held the leverage, possessing credit balances in New York banks convertible to gold on demand, majorly constituted by the untouched proceeds from recent American loans to Europe.

4. The Dominance of International Bankers

When wielding control over the monetary structures of nations, international bankers ascend to the position of world rulers, dictating economic and social trajectories within manipulated nations.

5. Intent Behind Fixed Gold Ratios

The unyielding determination of international bankers to uphold a fixed ratio of America’s currency to gold aligns with their ability to manipulate national monetary frameworks.

Their prowess lies in maintaining a consistent ability to buy gold for a fixed sum in dollars, destabilizing the structure when gold exits the system.

Dive into Arthur Kitson’s “A Fraudulent Standard” to uncover the truth behind monetary systems and their impact on economic stability

Unraveling Exchange “Freedom”

What Constitutes “Free” Exchanges? “Freeing” exchanges entails permitting fluctuations in the dollar’s value concerning other currencies like shillings, francs, or marks, based solely on the interplay between demand and supply.

For instance, if one ounce of gold equated to 20.67 dollars and 85 shillings represented the same gold unit, a pound sterling might be purchased in the foreign exchange market for $4.86.

If a surge in demand elevates the cost of a pound sterling to $4.90, known as the gold point, the discrepancy between $4.8667 and $4.90 accounts for gold shipment expenses.

Under this system, no one would pay beyond $4.90 for a pound sterling, opting to acquire and transport gold instead.

Upon arrival in a foreign country, this gold could be exchanged for the destination’s currency.

Heavy demand for pounds sterling and easily obtainable gold in significant amounts can induce a country’s downfall, considering gold’s foundational role in domestic loan structures.

Impact of Unrestricted Exchanges

In a scenario where exchanges were “freed,” the ability to pay for imports or maneuver vast speculative funds in gold at a constant cost, like $4.90 per pound sterling, would be disrupted.

The expense would escalate in proportion to the demand, possibly reaching $4.95, $5.00, or $5.10 per pound sterling.

Consequently, importers settling bills in London might face increased costs when obtaining pounds sterling.

Should the price surge too high, importers might refrain from foreign purchases unless offered exceptionally competitive rates or procuring a more economically advantageous product from that country.

Unveiling the Veiled Manipulation

Why do we endure these unsound practices of International Bankers?

The American populace tolerates these detrimental practices primarily because many haven’t grasped the covert strategies employed by internationalists.

These tactics silently erode their wealth and property, leaving honest individuals unaware of the harm inflicted upon them.

Discover the hidden truths in Arthur Kitson’s “The Bankers Conspiracy! Which Started the World Crisis” and explore the forces behind global economic turmoil.

Disrupting Bankers’ Dominance

Would allowing gold prices to fluctuate in tandem with general raw commodity prices and foreign exchange demand diminish the illegitimate power wielded by international bankers? Undoubtedly.

Consequently, these bankers relentlessly strive, through elaborate campaigns and persuasive rhetoric, to coerce the nation into embracing a fixed gold ratio.

Their aim in stabilizing gold at $35.00 per ounce lies in misleading honest Americans, masking their real intentions behind the guise of a stable ratio.

Unmasking Financial Manipulation

Exploring the historical nuances of monetary policies and gold standards unravels a world shrouded in intricacies.

From the Gold Bill of 1934 to the covert maneuvers of international bankers, the financial landscape has been a canvas of strategic decisions that have shaped global economies.

These practices often elude the common understanding of the average citizen, fostering a facade of stability while concealing the true consequences of fixed gold ratios and manipulated exchanges.

The Need for Awareness

Understanding these complex economic mechanisms is crucial.

It’s through this knowledge that the populace can safeguard against the veiled control of financial structures, preventing the erosion of wealth and economic stability.

Awareness and comprehension are the tools that can dismantle the deceptive facade crafted by international financiers, ultimately empowering individuals to navigate the intricate web of financial systems with clarity and resilience