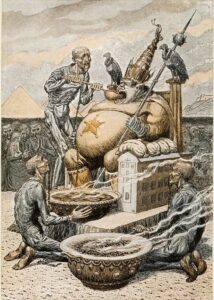

Amidst the ongoing debate surrounding the persistence of our existing monetary structure and policies, a forecast of the repercussions emerges—a foreboding tale of dominion, manipulation, and systemic decay.

Left unchecked, this trajectory portends a world where private interests mint currencies, wielding control over industries, governments, and even education and media.

The citizens, burdened by overwhelming costs and subdued wages, find themselves trapped within a labyrinth of inflation, wars perpetuated by international monetary manipulations, and burgeoning debt.

As the fabric of societal principles unravels, the ominous specter of dictatorship looms, threatening the very essence of freedom and social equilibrium.

The repercussions extend beyond the economic realm, permeating the social and political spheres, hinting at a future veiled in chaos and disavowal of foundational values.

The Perilous Continuation of Present Monetary Systems

In exploring the precarious trajectory of our current monetary systems lies a tapestry of warnings, each number revealing a potential collapse in societal and economic structures.

This catalog of concerns, intricate and consequential, portrays the dangerous aftermaths that could result from upholding the status quo.

Each point in the enumeration highlights a pivotal threat, unraveling the intricate intricacies of a system on the brink of instability and discord.

- Privatized Coinage: Money creation falls into the hands of individuals, serving their self-interests.

- Corporate Subjugation: Crucial production sectors, like automobiles and textiles, succumb to control by private money creators.

- Government Under Duress: The corridors of power become puppeteered by moneyed elites, dictating governmental actions.

- Media Deception: Press integrity diminishes as advertising from banker-driven corporations obscures truth dissemination.

- Educational Isolation: Economic realities are expunged from educational curricula, steering the populace away from essential knowledge.

- Subsistence Employment: Citizens toil in mortgaged farms or banker-controlled industries, receiving meager annual wages.

- Currency-Driven Conflicts: Wars persist due to international money manipulation orchestrated by select money creators.

- Transient Prosperity: Momentary prosperity emerges only during wartime preparation and engagement.

- Debilitating Bonds: Non-productive bonds perpetuate taxation, siphoning production profits for the benefit of debt creators.

- Inflation Hypocrisy: Vocal opponents of inflation perpetuate a greater inflation surge than witnessed in history.

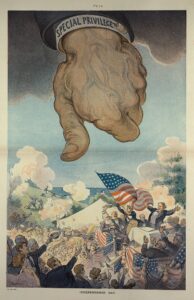

- Erosion of Liberties: Citizens, weighed by war costs, might relinquish hard-won liberties for the bare necessities controlled by plutocrats.

- Inevitable Dictatorship: Extreme ideological dictatorships emerge amidst economic and social instability.

- Misplaced Blame on Faith: Christianity faces unwarranted disavowal, unjustly blamed for societal woes spawned by the flawed monetary system.

- Burden on Future Generations: Unintelligent financial systems mortgaging the unborn, casting blame on future generations.

- Imminent Civilization Chaos: A continuum of these policies spells chaos across law, governance, and societal norms.

Discover “A Fraudulent Standard” by Arthur Kitson, exposing the hidden flaws in monetary systems and challenging conventional economic standards with insightful analysis.

Consequences of Continuing Down The Federal Reserve Banking System

Under the continuation of the current monetary system, various critical aspects of society would face dire consequences, precipitating far-reaching ramifications.

Privatization of money creation would emerge, empowering individuals to mint currency for personal profit rather than collective welfare.

Furthermore, pivotal industrial sectors, including automotive, steel, and textiles, would fall under the sway of private money creators.

This pivotal shift would result in economic policies crafted for individual gain rather than broader societal advancement.

Discover “The Secrets of the Federal Reserve” by Eustace Mullins, revealing the hidden history and powerful influence of the Federal Reserve on global economies.

Undermining Democracy: Impact of Financial Elites on Governance and Education

Concurrently, governmental affairs would be influenced and potentially dominated by an affluent minority, potentially compromising democratic processes and sacrificing the common good for narrow interests.

Media outlets, largely reliant on advertising revenue from financially dominant corporations, would continue to shape narratives that serve private agendas rather than public truths.

Such influence would further ostracize economic truths from educational curricula, perpetuating a significant lack of understanding among students about monetary principles and economic systems.

Financially, an uninformed citizenry would struggle as they find themselves employed within mortgage-controlled farms or banker-controlled industries, receiving diminished wages that barely sustain a decent standard of living.

Discover “The Bankers Conspiracy! Which Started the World Crisis” by Arthur Kitson, exposing the hidden forces behind global economic turmoil and their impacts

Globalized Conflicts: The Impact of Financial Power on Wars and Economic Stability

International control of gold and currency by a select group in each country would perpetuate wars and global conflicts, fostering an era where periods of economic prosperity primarily arise during wartime preparations.

Non-productive bonds, designed to drain profits from productive sectors through taxation for the benefit of debt creators, would exacerbate financial strain on society.

Those condemning inflation threats would inadvertently introduce heightened inflation, impacting nations globally.

Citizens burdened by war costs and economic downturns might blame democratic governments, potentially sacrificing liberties for basic survival.

Monetary Flaws and Impending Chaos: Risks to Civilization

Societies would face the looming risk of dictatorship, regardless of political ideology, due to economic turmoil and societal unrest.

Christianity’s principles of social justice and sovereign control of money issuance may be discredited, attributing war, poverty, and discord to its teachings.

Future generations would bear the consequences of an unsound monetary system, burdened by debt and financial constraints before their birth.

The continual reliance on the existing monetary system would inevitably result in legal, governmental, and societal chaos, posing substantial risks to civilization.

Explore “The Role of Money” by Frederick Soddy, a groundbreaking analysis on how money shapes economies, influences global stability, and affects societal welfare.

The Ominous Future: Consequences of Persisting Monetary Systems

As we envisage the consequences of persisting with flawed monetary systems, a harrowing panorama unfolds.

From economic manipulation by a select few to the ominous echoes of dictatorship and societal disarray, the repercussions loom large.

These systems risk rendering democratic processes impotent, distorting educational truths, fostering global conflict, and shackling future generations with debt.

A continued reliance on such fragile systems threatens to plunge societies into chaos, eroding the very fabric of governance, law, and societal order.

It’s incumbent upon us to heed these warnings, for the cost of inaction may well be the unraveling of our societal foundations and the future we bequeath to the generations to come.