Money holds an omnipresent role in our lives, yet the process behind its creation remains shrouded in mystery.

The ins and outs of money’s origination and control, especially in banking systems, bear significant implications on our economy.

Let’s unveil the secrets behind the creation and manipulation of money in the financial world by answering a series of pivotal questions.

Unveiling the Reality of Bank Loans: Dissecting Money Creation

The concept of borrowing money from a bank appears straightforward—yet, behind the curtain, lies a complex process that defies common belief.

Let’s uncover the hidden mechanisms and explore the surprising truth about how banks create money seemingly out of thin air.

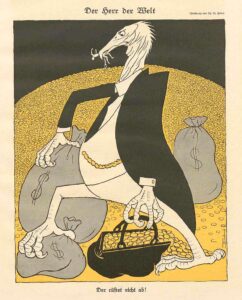

Unveiling the Money Trust: Charles A. Lindbergh, Sr.’s ‘Banking and Currency‘ Peels Back Layers to Expose Insights into the Complex World of Finance and the Dominance of the Money Trust

Dispelling Misconceptions

Contrary to popular belief, banks don’t merely redistribute deposited funds when extending loans.

Instead, they operate by lending something intangible: “promises-to-pay” money.

These promises have been historically lent in quantities far surpassing the banks’ actual reserves.

The Art of Money Creation

The wizardry begins when an individual, say John Jones, seeks a loan.

Approaching the bank with assets and figures indicating the value of his possessions, John pledges these assets as collateral for the loan.

This enables the bank to manufacture money through a series of ledger entries.

Decoding Bookkeeping Alchemy

Once the bank approves John’s loan request, a ledger entry magically infuses the financial system with newfound money.

The bank records the loan as an asset while simultaneously noting a corresponding liability—creating money virtually with a simple pen stroke.

Discover the Layers: Eustace Mullins’ ‘The Secrets of the Federal Reserve’ Peels Back the Veil on the Monetary System, Exposing Hidden Realities and Providing Unique Insights

The Illusion of Bookkeeping Money

Remarkably, John doesn’t walk out with physical cash.

Instead, he receives a bank book, reflective of the deposit credited to his account—a mere bookkeeping entry representing the newly created money.

This revelation shatters the conventional notion of loans and unveils the intricate process through which banks generate money by leveraging assets, profoundly impacting the economy’s monetary dynamics.

Demystifying Bank Deposits: The Truth Behind Transactions

Bank deposits—what appears to be solid figures on a balance sheet—hold a deeper truth, one that eludes common perception.

Let’s unravel the reality behind these seemingly concrete numbers and explore the intricate dynamics of bank operations.

Deposits: A Bank’s Liabilities

Contrary to the belief that deposits represent tangible assets within a bank, they are, in fact, liabilities—merely promises owed by the bank to its customers.

This revelation, learned by countless Americans in recent years, exposes the essence of a bank deposit: a mere commitment, not actual wealth.

The Power of Newly Created Deposits

When individuals like John Jones receive newly created deposits, the potential for economic activity emerges.

John can issue checks against this deposit, utilizing the bank’s promise as a medium for various transactions, from paying employees to acquiring resources for his business operations.

Interconnected Banking: The Check Game

The intricate system of checks and balances within the banking sector allows for a seamless flow of these manufactured deposits between institutions.

This synchronized interplay among banks is crucial, facilitating the exchange of fictitious bookkeeping money for tangible goods and services.

Unveiling the System’s Deception

Despite the appearance of legitimacy, this system is far from honest.

By leveraging real assets to secure fictitious bookkeeping money, banks wield tremendous power to create money without bearing the true cost—forcing borrowers like John Jones and the American public to pay interest on this manufactured currency.

Delve into the pages of ‘The Bankers’ Conspiracy: Which Started the World Crisis‘ by Kitson, a culturally significant work that sheds light on pivotal events in history.

This meticulously preserved piece offers invaluable insights into the roots of global economic turmoil, now freely available for all to explore and appreciate

Impact on Price Levels: Supply and Demand Dynamics

The injection of newly created money into circulation exerts a palpable influence on price levels.

surge in available currency without a proportional rise in goods or services causes the unit value of money to decrease.

This inflationary effect amplifies prices, mirroring the age-old law of supply and demand.

The analogy of the egg market vividly illustrates this economic principle: with an increased amount of money chasing the same quantity of goods, prices soar in response to heightened demand.

Banking the Nation: Unveiling the Government-Bank Relationship

The intricate dance between banks and the United States Government is a lesser-known yet crucial aspect of our economic landscape.

The creation and circulation of money for government use, shrouded in mystery, hold profound implications for the financial well-being of the country.

From Citizens to the Government: The Money Trail

Banks, contrary to popular belief, don’t just manufacture money for private individuals.

They extend this practice to lend substantial sums to the government itself.

But where does this money originate, particularly when the government issues bonds?

Crafting Money: The Intricate Process

The process begins with the Bureau of Engraving, engraving United States Bonds, effectively serving as a mortgage on various aspects of the nation’s wealth.

Allocated to local banks, these bonds become a linchpin in a system that might seem like a “something-for-nothing” proposition.

The Bookkeeping Alchemy

Upon receiving these bonds, banks don’t receive actual tangible assets but rather make bookkeeping entries, generating “credit” in the form of deposits in the government’s name.

This act, validated by the Federal Reserve Board’s Governor, essentially creates new money in the economy.

The Role of Bank-Created Credit Money

This newly minted currency, known as credit money, seamlessly integrates into our financial ecosystem.

It substitutes actual national currency in nearly 95% of all transactions, transferred primarily through the use of checks.

Dive into the illuminating narrative of ‘A Fraudulent Standard‘ by Arthur Kitson, a timeless exploration into the intricate web of economic deception.

Unveiling the intricacies of financial fraud, this culturally significant work stands as a beacon of enlightenment, now accessible for all to uncover and appreciate, thanks to its preservation for the benefit of generations to come

The Check’s Story: A Transfer of Wealth

Checks become the conduit for this credit money, functioning as written directives for banks to transfer funds between accounts, making possible the flow of credit money between individuals and institutions.

The intricate relationship between banks and the government, culminating in the creation of money through bookkeeping entries and the circulation of credit money, underpins a significant portion of our economy.

Understanding this process sheds light on the complex financial mechanisms shaping our nation’s fiscal landscape.

The Invisible Mechanics of Money: Unveiling the System

In the labyrinthine world of finance, the creation and circulation of money hold secrets that significantly impact our everyday lives.

Delving into the profound revelations from the past sheds light on the intricate relationship between banks, individuals, and the government.

Checks: The Deceptive Form of Money

Checks, seemingly innocuous, perform the pivotal function of transferring money—the lifeblood of our economy.

The largest part of the money in circulation is in the form of bank credit or deposits, as revealed by the testimony of the Governor of the Federal Reserve Board during the 1935 Banking Act hearings.

Money, Debt, and the Cyclical Relationship

Under this system, the existence of money is intrinsically tied to debt.

The more significant the debt, the greater the volume of money.

This structure has fundamental flaws that plague our economic landscape:

- The Tribute of Interest: Every citizen becomes a contributor, paying tribute (interest) to banks merely for the existence of the medium of exchange. This invisible tax burdens individuals, siphoning off their hard-earned wealth.

- The Collapsible Money Structure: Money is loaned into existence, subject to being recalled by bankers, thereby affecting price levels. A reduction in money leads to a domino effect—falling prices, unemployment, and foreclosures—a stark reality witnessed during the cycles of prosperity and depression.

The Vanishing Money: A Dire Consequence

The act of repaying loans reduces the money in circulation.

When numerous individuals repay loans simultaneously, a substantial volume of the medium of exchange vanishes, resulting in distorted price levels, unemployment, income loss, and the consolidation of wealth in the hands of a select few.

Unveiling Currency’s Role

Currency—those familiar bills we carry—is only a small fraction (about 5%) of the total transactions.

Its usage is more about convenience for small transactions, as the majority of business deals occur through the transfer of funds via checks.

The Enigmatic Origin of Currency

The origins of currency are deeply interwoven with the Federal Reserve System, an entity with a profound impact on the monetary ecosystem.

Further exploration of currency types and origins lies in comprehensive resources like “Money Creators” by Gertrude M. Coogan.

Unraveling the mysteries of our monetary system showcases the delicate balance between debt, money, and the control mechanisms wielded by financial institutions.

Understanding these mechanisms is pivotal in navigating the intricacies of our economic reality.

Stay tuned for deeper insights into the financial ecosystem and its implications for society.

Unveiling the Fundamental Flaws in the Money System

A Recapitulation: The Invisible Tax on Money

- The Genesis of Money: Money originates not from a government treasury but from private bankers extending loans to individuals or the government itself. This mechanism is the bedrock of our financial ecosystem.

- Tribute Paid to Private Bankers: Individuals and governments, upon receiving loans, are compelled to pay unearned interest to these private entities—a tribute for the creation of money that sustains our economic transactions.

- Invisible Tax on Exchange: The very existence of the medium of exchange (money) forces users to bear an invisible tax, compelling them to contribute a portion of their earnings to the banking system, despite having earned it through their labor.

- Money’s Vanishing Act: As loans are paid back or recalled, money is eliminated from circulation. This decrease in the volume of money instigates a chain reaction of falling price levels, wage cuts, and property confiscations.

- The Grim Collapse: With dwindling money volume, a catastrophic collapse looms—homes are seized, wages diminish, and financial structures crumble, leaving individuals and economies reeling from the aftermath.

- Insufficiency of Currency: During such a collapse, both bank deposit money and smaller denominations of physical currency ($5 and $10 bills) prove insufficient to sustain the necessary business transactions, plunging the economy into disarray.

The Conclusive Insight

This cycle of money creation and its subsequent withdrawal highlights the precarious nature of our monetary system.

The interplay between lending, interest, and the inevitable collapse underscores the urgent need for a more robust and equitable financial infrastructure.

Understanding these fundamental flaws opens the door to critical discussions on financial reform.

Stay tuned for deeper insights into the potential solutions and alternative systems that can revolutionize the way we perceive and engage with money.

Unveiling the Federal Reserve System: The Masterminds Behind Money Control

Curious to delve deeper into the mechanisms governing the money flow and its control?

Our next blog post will decode the intricate workings of the Federal Reserve System, shedding light on its role in shaping the nation’s financial landscape.

Intriguingly complex yet critical in its implications, understanding the genesis of money and its control by private entities unveils a world of financial intricacies that impact our daily lives.

Stay tuned as we unravel more on this captivating subject in our next post!