You hear about Bitcoin miners. You picture people with pickaxes digging in a digital cave.

That image is wrong.

Bitcoin mining is not about digging. It’s about securing.

It is the ingenious process that allows a decentralized, trustless financial network to exist without any central authority.

Miners are not searching for coins. They perform a critical service.

They are the auditors, the guards, and the mint of the entire Bitcoin network.

They convert real-world energy into unbreakable digital security.

This process is called Proof-of-Work.

In this guide, we’ll demystify Bitcoin mining.

You’ll learn how it works in simple terms, why it intentionally uses energy, and how that energy is exactly what makes Bitcoin the most secure monetary network ever created.

Let’s uncover the engine that powers Bitcoin.

If you’re brand new and want a simple, no-nonsense walkthrough, this Rebel’s Guide to Buying Bitcoin breaks down everything step by step.

The Core Problem: Who Gets to Update the Ledger?

Imagine a global financial ledger that anyone can see.

This ledger records every Bitcoin transaction that has ever occurred.

The critical question is simple:

Who gets to add the next page? Who decides which transactions are valid?

In the traditional system, a central authority makes that decision.

Banks can censor payments. Governments can freeze accounts.

Bitcoin had to solve this problem without trusting anyone.

Its solution was radical:

Let everyone compete for the job. That competition is called mining.

Proof-of-Work: Earning the Right to Record History

Bitcoin does not hand control to anyone for free.

To earn the right to add the next block of transactions, participants must prove they have spent real resources.

This proof is called Proof-of-Work (PoW). Think of mining like a global lottery.

But instead of buying tickets with money, miners buy tickets with computational work and electricity.

The more computing power you contribute, the more chances you have to win.

The winner earns two things:

-

The right to record the next block of transactions

-

A reward paid in Bitcoin and transaction fees

This system accomplishes two critical goals:

-

Decentralization: No single entity can easily control the network

-

Security: Cheating becomes prohibitively expensive

The Miner’s Toolkit: Hashes and a Global Lottery

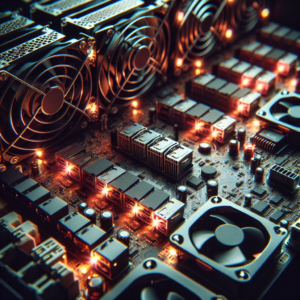

Miners use specialized computers called ASICs (Application-Specific Integrated Circuits).

These machines do one thing extremely well:

They calculate trillions of cryptographic hashes every second.

A hash is the output of a mathematical function.

You put data in, and you get a fixed-length string of characters out.

It works in only one direction. You can’t reverse a hash to uncover the original data.

Miners are given a target hash that starts with a specific number of zeros.

Their job is to find a random number—called a nonce—that, when combined with the block data, produces a hash below that target.

This is a massive guessing game. Trillions of guesses per second.

When a miner finally finds a valid solution, they broadcast it to the network.

Other nodes verify it almost instantly.

If it checks out, the block is added to the blockchain. History is extended.

The Reward: Why Miners Play the Game

Mining works because incentives are aligned. The reward has two parts.

1. The Block Subsidy

This is newly created Bitcoin.

It began at 50 BTC per block and is cut in half roughly every four years in an event known as the halving.

Today, the subsidy is 3.125 BTC. This is how new Bitcoin enters circulation.

2. Transaction Fees

Users attach fees to transactions to encourage faster confirmation.

Miners naturally prioritize higher-fee transactions.

These fees are collected by the miner who wins the block.

Together, these rewards make honest participation profitable.

Attacking the network would cost more than any possible gain—and would destroy the value of the asset being earned.

Difficulty Adjustment: Keeping Bitcoin on Schedule

What happens if thousands of new miners suddenly join?

Blocks would be found too quickly.

What if many miners shut off their machines?

Blocks would slow down. Bitcoin solves this automatically.

Every 2,016 blocks (about two weeks), the network adjusts mining difficulty.

-

If blocks came too fast, difficulty increases

-

If blocks came too slow, difficulty decreases

The result is remarkable:

A new block is produced roughly every 10 minutes, no matter how many miners exist.

This is a core feature of Bitcoin’s predictable, sound monetary policy.

Hash Rate: The Pulse of Bitcoin’s Security

The total computing power protecting Bitcoin is called the hash rate.

It is measured in hashes per second. Think of hash rate as Bitcoin’s immune system.

A higher hashrate means:

-

More competition

-

Greater difficulty

-

Stronger security

To attack the network, an adversary would need to overpower this enormous wall of energy and computation.

That cost is measurable—and massive.

Proof-of-Work vs. Proof-of-Stake

Some cryptocurrencies use Proof-of-Stake (PoS) instead.

The difference is fundamental.

Proof-of-Work

-

Secured by external resources (energy, hardware)

-

Requires real-world cost

-

Creates objective, physical resistance to attack

Proof-of-Stake

-

Secured by internal financial deposits

-

Power flows to the largest holders

-

Risks centralization over time

Proof-of-Work forces security to exist outside the system.

That external anchor is what makes Bitcoin uniquely resilient.

Addressing the Energy Question

Yes, Bitcoin mining uses energy. That is the point.

The real questions are:

What kind of energy?

Miners often use stranded or wasted energy—flare gas, excess hydro, surplus renewables.

What does it secure?

A global, neutral, censorship-resistant monetary network.

We already spend enormous energy securing the traditional financial system.

Bitcoin simply makes that cost transparent.

The energy is not wasted. It is converted into digital truth.

How You Can Participate

You don’t need to mine Bitcoin to benefit from it.

Mining secures the network. Using Bitcoin is how you participate.

The simplest path is acquiring satoshis—the smallest unit of Bitcoin.

Services like Swan Bitcoin allow automatic, recurring purchases, letting you build long-term ownership without touching mining hardware.

In Bitcoin and the Future of Digital Cash Systems, you’ll see why Bitcoin matters as digital cash evolves.

The Bottom Line: Energy Converted into Truth

Bitcoin mining is not pointless. It is not wasteful.

It is a competitive process that transforms electricity into certainty.

Miners turn energy into immutable history.

They make Bitcoin censorship-resistant, neutral, and impossible to manipulate.

This is how a monetary system runs without rulers.

This is how truth is enforced without trust. This is Proof-of-Work.