Money has always survived or failed based on one simple truth: the harder it is to create, the more people trust it.

When a natural, political, or technological change makes a money supply easy to expand, that money loses its strength.

History shows this again and again. Seashells worked as money only when they were rare.

In prisons, loose cigarettes act as currency because they are hard to get.

When Money Gets Easy, Trust Disappears

Even modern national currencies depend on a slow and predictable supply.

When new units are created too fast, people stop holding them.

They look for something with a stronger stock-to-flow ratio and a supply they can trust.

This is one reason many people turn to Bitcoin.

Its supply is fixed, and it cannot be inflated at will.

How Easy Money Dies and Hard Money Survives

Modern technology shows what happens when a money becomes easy to produce.

Once societies could import or gather seashells with little effort, seashell money collapsed.

People shifted to metal or paper because those forms were harder to expand.

The same pattern holds today.

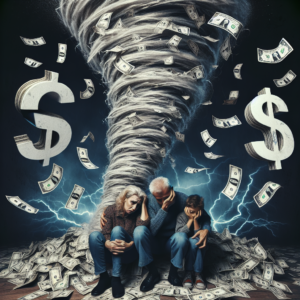

How Inflation Forces People to Protect Their Wealth

When a government prints too much currency, its citizens protect themselves.

They move their savings into foreign money, gold, or any asset with a tighter supply.

Sadly, the twentieth century is full of painful examples of this, especially in developing nations.

The monetary systems that lasted the longest were built on strict limits to supply growth.

In short, they relied on hard money.

The Battle of Money: Scarcity Decides the Winner

Monetary competition never stops.

The winner is always the form of money with the stronger stock-to-flow ratio.

Technology shapes these outcomes, and we will see more of this in the next chapter.

Why Hard Money Protects Wealth Over Time

People can choose almost anything to use as money. Yet, over time, those who hold hard money usually come out ahead.

Hard money keeps its value because its supply grows very slowly.

Easy money does the opposite. Its supply rises fast, and its price falls.

Some people learn this through careful planning.

Others learn it through harsh experience.

Either way, most wealth ends up with people who choose the hardest and most salable money.

Hard Money Shifts as Societies Develop

However, hardness is not fixed. It changes as technology changes.

When societies gain new tools or new production methods, the difficulty of creating certain goods also shifts.

This affects how easily each good can be sold or traded.

Because of this, the best type of money has always depended on the technology and conditions of each era.

Austrian Economists and the Market Roots of Money

Austrian economists help clarify this idea.

They avoid strict or dogmatic claims about one perfect form of money.

Instead, they explain that sound money is whatever people freely choose in the open market.

It rises from use, not government force.

Its value comes from real market interaction, not political control.

Salerno’s Insight: Hard Money Rises Without Force

Joseph Salerno explains this well in his book Money: Sound and Unsound.

Free-market monetary competition is brutally honest.

It rewards people who hold hard money and protects their wealth over long periods.

Hard Money Emerges Naturally—Not by Government Order

No government needs to impose the hardest money on society.

People discover it on their own.

In fact, government control usually slows this natural process.

Today, many see Bitcoin as the next stage of hard money.

How Sound Money Shapes Choices, Behavior, and Society

The effects of hard and easy money reach far beyond simple profit or loss.

They shape how people think, plan, and live.

This idea sits at the heart of The Bitcoin Standard and is explored deeply in Chapters 5, 6, and 7.

Weak Money Kills the Ability to Think Long Term

When people can store their wealth in a reliable form of money, they think more about the future.

They save. They plan. They invest in long-term goals.

But when their money loses value quickly, they focus on the present.

They struggle to look ahead because their savings melt over time.

This is why the strength of a monetary system matters.

If you want to understand how rebels approach ownership and self-custody, this [Bitcoin freedom guide] explains the philosophy and the tools.

Time Preference: How Money Shapes Our Decisions

A sound form of money holds its value.

It encourages people to slow down, think clearly, and build for the years ahead.

A weak form of money pushes people toward short-term decisions.

In economics, this difference is called time preference, and it plays a major role in shaping both individuals and entire societies.

If you want to understand more about these ideas, The Bitcoin Standard is a great book to read.

Hard Money Builds Stronger Futures

Hard money has always outlasted weak money.

It protects savings. It rewards long-term thinking.

It creates stable families and stronger societies.

Easy money does the opposite.

It pulls people into short-term choices and constant financial stress.

As history shows, the form of money a society chooses can shape its entire future.

Start Your Hard Money Journey With Bitcoin

Bitcoin enters this story as a new form of hard money.

Its supply is fixed. Its rules cannot be changed by political pressure.

People can save with confidence because no one can inflate it at will.

If you want to take your first step into hard money, you can claim $10 in free Bitcoin.

It helps you begin your journey and helps me keep creating content that pushes back against a broken system.

Final Thoughts: Why This Matters Today

Sound money is not just a financial tool.

It is a foundation for stability, responsibility, and real independence.

As more people explore Bitcoin, the lessons of history become clear.

The future will belong to those who choose money that cannot be diluted or controlled.